As part of our protocol, we have developed an analytical tool that allows us to quickly assess where a company is in its preparation to scale.

A company achieves scale when it is experiencing exponential growth (where revenue per community member increases as the size of the community grows) and revenue economies (proportionate reduction in costs by each increased level of sales).

ScaleWerks’ Definition

Mid-life companies that have been successful in growing their business – but want to accelerate their corporate valuation by scaling – experience a common set of hurdles. We know this because of our research and confirming in-field experience. In fact, we’ve spent our careers developing, validating, and proving a protocol for scaling mid-life companies.

As part of our protocol, we have developed an analytical tool that allows us to quickly assess where a company is in its preparation to scale. Here’s the backstory and an invitation to learn where your company is in your preparation to scale.

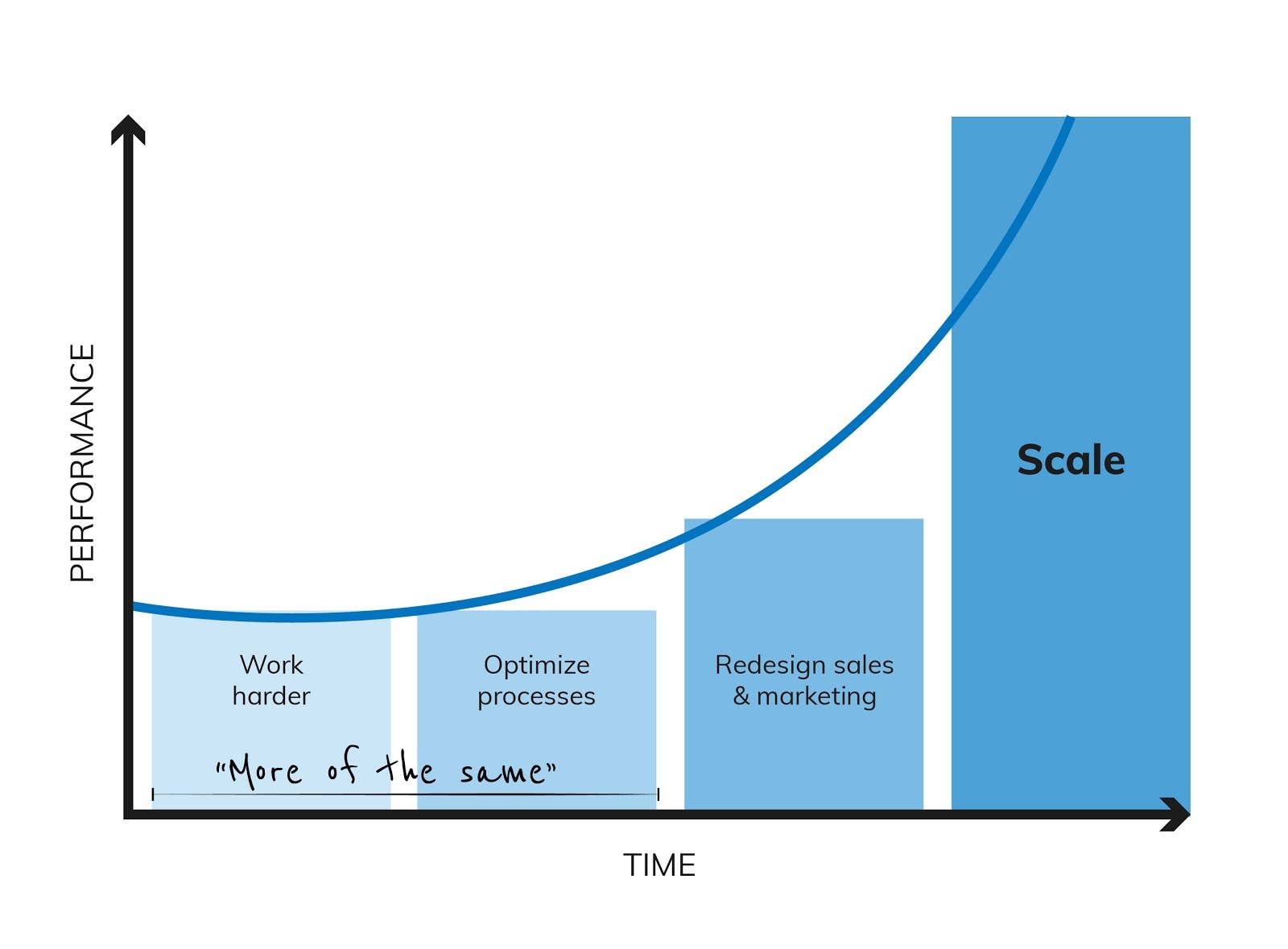

Work Harder. The first area of effort is the most common. It originates from a familiar experience for seasoned business leaders: periods when sales growth slows, profit margins get squeezed and return on assets in general decreases. The typical response is to work harder. The “Work Harder” response customarily includes:

When working harder doesn’t provide the returns that are needed – or is unstainable because of the toll it takes on the members of the organization, there is a move to work smarter.

Optimize Processes. Working smarter starts with initiatives to optimize the processes of the business. These endeavors regularly include:

All with the goal to increase efficiency, effectiveness, collaboration, and ultimately, profits.

Optimization initiatives and advancements will deliver meaningful results, but over time those efforts meet with marginal returns on effort. Assuming the optimization processes are successful, the company will enjoy short-term cost, quality, and efficiencies that can be used to change the product and pricing strategy; which in turn inspires the leadership to redesign sales and marketing efforts.

Redesign of Sales and Marketing. Redesign of sales and marketing efforts customarily include:

However, those sales and marketing efforts are fated to marginal returns as competitors recognize the efforts and match them.

Realizing that the product sales and marketing efforts don’t deliver transformative performance gains – and recognizing that these efforts are nothing more than adjustments to the current business model – the company comes to grips with the hard truth that their effort must be placed into rethinking the entire business model. And here’s where it gets hard.

Business model innovation should enable the company to reorganize the market by transforming the customer base’s perspective on the experiences it demands. The outcome for the company is that it moves from niche player to Category Leader, and from Category Leader to Scale.

Our empirical evidence proves that innovating a company’s business model will significantly increase company value.

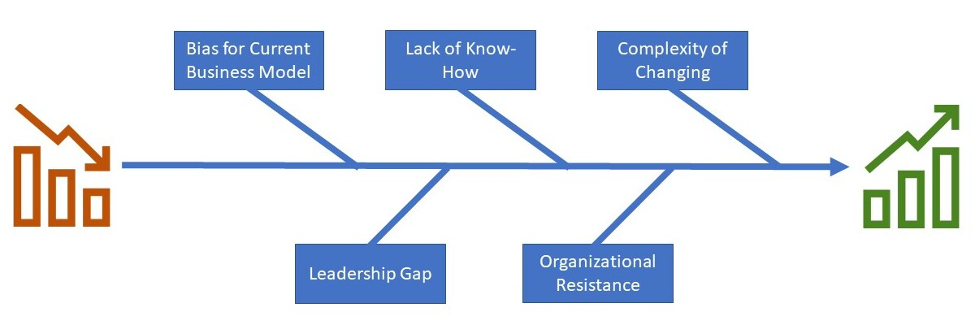

So why don’t more companies dig in and change business model? In our work we bump up against two central challenges (often reinforcing each other). The first challenge is perspective. Leadership cannot perceive a new approach to doing business. The second is inertia – the organization itself is packed with barriers to changing the existing business model. The barriers break down as:

We have created a series of assessments that can give you high-level insight into the scale-preparation areas of challenges yet to be addressed, and your capability to transform your business model for scale. These assessments address these issues:

If you’d like to get these insights, start with the first assessment – that’s located here.

We know that transformation is not a single initiative … and Scale is not a program; Scale is a way of seeing the world – it’s a perspective– it’s a lifestyle. And like any healthy lifestyle, it can be learned, internalized and be a source of life-sustaining energy.

According to a McKinsey Corporate Performance Analysis, less than 8% of strategic initiatives result in performance improvement.

As seasoned authorities in sustainable value creation, we’ve made careers of leading those that are in the 8%.