The company bid short-run replacement parts from manufacturer-owned prints. Over time the designer/manufacturers of components and parts had changed their strategy and were providing repair parts services as part of their offering – thus reducing the volume of machine-to-print work.

A company in the precision machining business servicing large manufacturers of heavy equipment and large specialty parts was losing market share to firms with newer equipment and more extensive engineering/original design and re-design support services.

The company bid short-run replacement parts from manufacturer-owned prints. Over time the designer/manufacturers of components and parts had changed their strategy and were providing repair parts services as part of their offering – thus reducing the volume of machine-to-print work.

ScaleWerks started the engagement by collecting data from the end-users perspective, analyzed and tested conclusions drawn from that data. We developed the hypothesis that if the company re-imagined itself as a direct-to-customer service center, it could create a category for online maintenance part monitoring and, as such, an online platform for uptime monitoring and assessment. This would deliver predictive information, just-in-time replacement part delivery, and suggesting part replacement before systems failures.

ScaleWerks then worked with leadership to prove the hypothesis, develop a SmartScale℠ strategy, and work shoulder-to-shoulder to execute the plan – including technology and organizational transformation successfully.

Customers reduced their costs of replacement parts and improved their maintenance programs. The company became the category leader with a community of maintenance professionals looking to the company as the authority to ensure that costly parts are available at the appropriate time and aftermarket pricing.

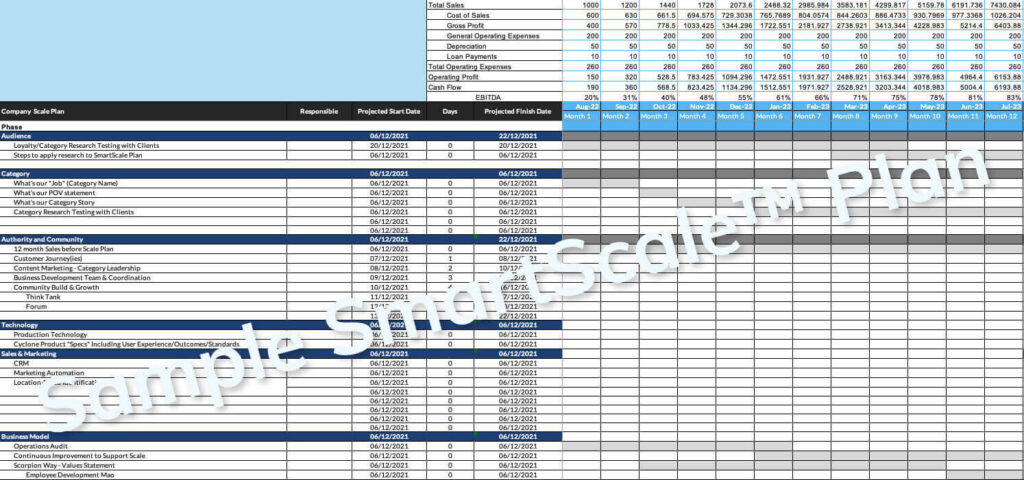

The company achieved scale, with a Revenue Growth of 18% CAGR and EBITDA of 23% as a process management company. This is in comparison to its previous position only as a high-quality precision machining business, with Revenue Growth at just 3% CAGR and EBITDA of 11%.

The company opened new, profitable business units. Enterprise appeal to employees and potential new hires increased (resulting in high-performance hiring contributors).

Practice areas quickly exchanged low-value customers for high mutual-value relationships, and the firm began regularly exceeding aggressive growth (20% per year), profitability (21% NOI), and enterprise value targets (valuation multiple increased from 5.5 to 9 11 based on new business model).