How to achieve the most valuable type of growth – enterprise value growth.

In the traditional (code word for “outdated”) way of thinking, value is an EBITDA multiple adjusted by customer concentration risk and future capital required. But thinking on that has recently changed. Enterprise value today is more heavily weighted towards customer equity. In fact, 65% of enterprise value is locked up in your loyal customer base and the lifetime value of those customers, including profit margins, retention rates, and referrals.

Why has customer equity, expressed as customer lifetime value, taken such a prominent position in valuation calculation? Because a loyal, growing customer base supports a robust and sustainable return on invested capital. A high lifetime value customer base suggests that leadership has created an enterprise with a clear focus on three corporate dictums: a sustainable strategy that propels company growth and protects capital allocation.

Middle market leadership is typically well-schooled in traditional thinking around business value creation. These conventional leaders think in terms of 4 primary types of growth: strategic, internal, organic, and partnership/acquisition/merger growth.

Organic growth includes new products. With more products or services, sales increase. However, organic growth often necessitates more physical space to build, package, distribute or serve customers. Because growth requires investment, conventional thinking suggests that organic growth, on its own, is not sustainable in the long term.

Strategic growth has a long-term focus. It’s a significant step up from the organic growth stage.

Ideally, the organic growth stage will have produced enough capital for a company to invest in a long-term growth strategy – and the human and physical resources needed to execute.

Examples of strategic growth strategies range from new products to marketing strategies targeting a new audience.

Internal growth utilizes available resources. It is the thinking and tactics used to stretch resources so that external funding can be avoided – or put off.

Internal growth includes implementing lean or executing business model changes for resource optimization. A well-executed internal growth strategy lays the foundation for efficient and effective business operations.

Partnership, merger, or acquisition is generally considered the riskiest growth strategy type and the strategy with the highest commonly perceived potential for reward.

This strategy can open entry into a new market, expand an existing customer base, expand production capabilities, help introduce new products more smoothly, or accelerate innovation efforts.

According to Harvard Business Review between 70% and 90% of mergers and acquisitions fail. It’s a shocking number, and the one thing all have in common is people. Mergers and acquisitions fail more often than not because key people leave, teams don’t get along or demotivation sets into the company being acquired.

These strategies have their roots in the pre-large dataset analysis days. They encouraged competing and competitive advantage – usually promoting better, faster, cheaper approaches to innovation, service, product, and supply chain management. These strategies assumed that the company would earn a respectable portion of the existing “addressable” market – and centered customer research around how to “attract” customers. (Heavy on the marketing, branding, and comparison to competitors.)

And these growth strategies work. But they don’t deliver the most valuable growth. That’s because they don’t focus on creating, developing, and growing the enterprise’s most valuable asset: Customer Equity.

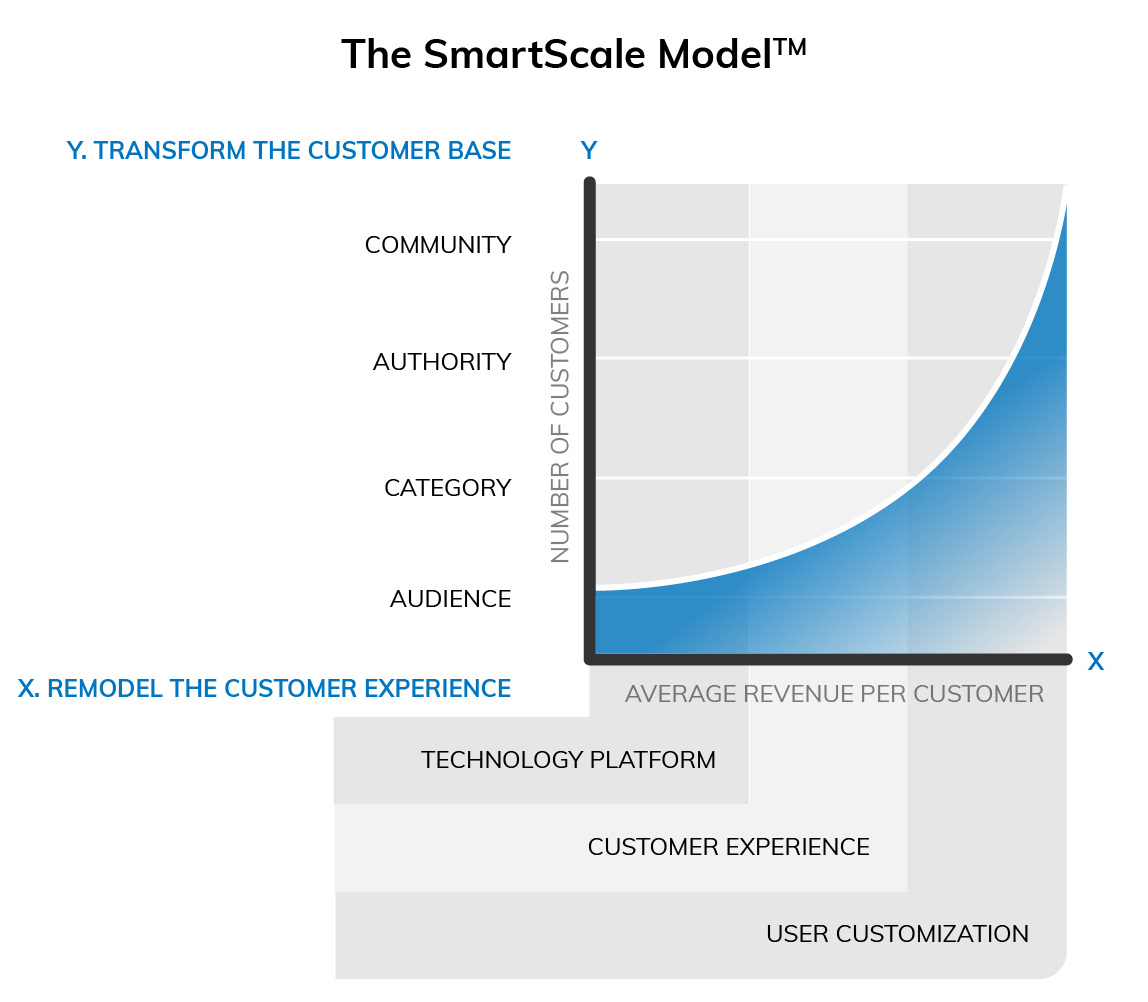

Category is not the new strategy – it’s the old one that only a few companies could pull off. Category to deliver Scale – that’s the new strategy. And it is a repeatable strategy given today’s research, data analytics, and organizational development resources and technologies. There’s even a tested, proven, reliable protocol that repeatedly delivers success.

The problem for most companies – and these tend to be the ones stuck in conventional thinking about growth, is that they don’t have deep enough insight into their prospect and customer base (what we refer to as “the audience”) to guide their business strategy. In fact, the insight that they do have may be biased (or just plain wrong) – driving tactics that debilitate the company’s ability to be successful.

A simple example of this: We worked with a company that made plastic products for the finishing industry. Customer satisfaction/net promoter score (as opposed to customer loyalty) research kept delivering high marks…around the dimensions measured, such as price and service. Salespeople used scripts to interview clients and prospects. The information gathered pointed to customer interest in receiving more features on existing products, a lower price point, and easier access to online ordering and order tracking information. Product management took that information and continued to find ways to reduce costs and improve service features. Their reward for following the insight they’d gained? Customers shared the same aspirations with competitors – and “a race to the bottom” was triggered.

Category with a focus on achieving Scale uses a different approach – instead of surveying and researching customer satisfaction, it analyzes customer loyalty. It gives unbiased insight into how to provide the customer with a better version of themselves instead of a shallow, simple insight into the product or service.

Customer loyalty explores:

Customer loyalty also measures the strength of the relationship between buyer and seller and between the organization and its customer.

The information gathered is analyzed to report customer loyalty at the time of the research and predict customer loyalty given a set of parameters to be achieved. The process of executing against this information (SmartScalingSM) delivers the scale curve in the ScaleWerks mode.

This process is so powerful that it can predict the future value of your customers – and your organization!

Loyalty research is a guidepost to corporate transformation. Transformations are hard work. Here’s a few pointers we’ve picked up along the way:

Companies with clear Category Leadership, high Customer Equity, and following a strategy to capitalize on the predictable growth generated by a well-executed customer lifetime value (aka customer loyalty) process achieve valuations 5-10 times higher than companies that are following conventional strategies. Why don’t more companies pursue a Category with a focus on Scale? In our experience it’s one or more of these reasons:

Are you ready to make a real change to transform your business from a growing enterprise to one that scales? Learn more about the SmartScale℠ process or contact us to learn how we can help.